If you are doing stock market trading, then making profit is a main goal for you and the most profitable traders do proper analysis with the help of special programs.

As we know, forex indicators are the mathematical functions which are based on evaluation of difference between price and bidding.

Most of the users are willing to choose divergence indicator because they are helpful to provide better results.

If you are doing some research in online, then you can easily choose the best indicator for divergence trading based on your needs.

To know about types of trading divergence

Now a day, different kinds of the trading divergences are available which includes

- Expanding

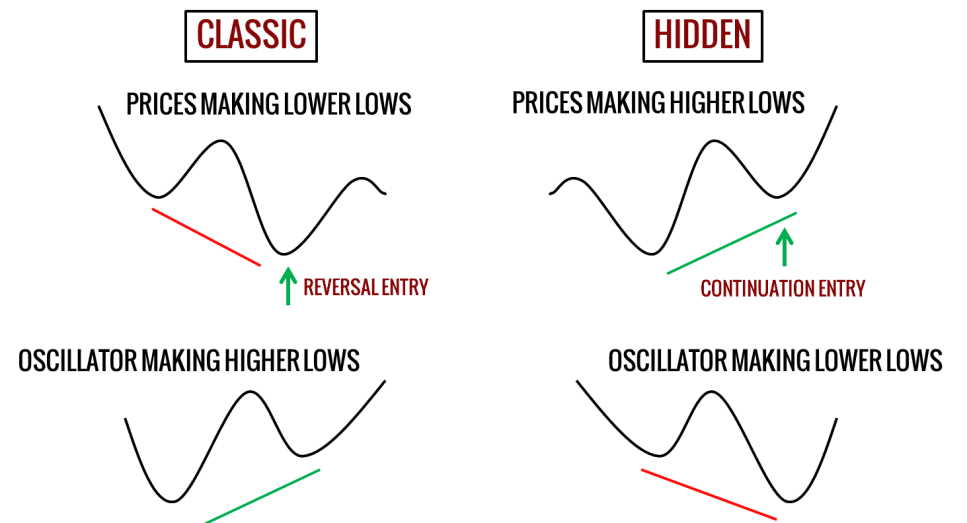

- Classical

- Reverse or hidden

To forecast changes, experts of the technical analysis might make different kinds of the instruments.

Basically, different types of divergence indicators are available so you must carefully pick the best one based on your needs. As we know, different platforms are having wide varieties of tools and choosing right usage of tool might lead to the good income.

Moving average divergence is considered as basic for entire trading system. It might depict direction of market by meaning calculating the distance between it and moving averages.

If you are a trader, then you must pay attention to the constant ascending or descending market because it helps to get better results.

Relative strength index enters ranges from the zero to hundred with the two additional levels. This kind of the type might indicate white and black candles without the shadows.

Majority of the traders might consider RSI is the best Forex indicators for using because it is offering amazing accuracy. The divergence and convergence tool is the best and finest powerful method.

Importance of divergence indicator in forex trading

As we know, divergence and convergence analysis is the effective support to predict future price as per currency values.

Basically, divergence Indicator in forex trading is the event that could be associated with maximized levels of the volatility.

Maximized volatility might create profitable trading opportunities in the given period of trading. If you wish to start your analysis, then using moving average convergence divergence indicator is the best choice because it might focus on using average from the multiple time periods.

Convergence or divergence could be evaluated once the price has formed like double top, lower than previous low, higher than previous high and double bottom.