Leverage based derivative products spread betting and contracts for trading on different financial markets in our time encourage many people worldwide to directly choose and invest in the appropriate product.

It is the suitable time to find the main difference between spread betting and CFD trading and make a well-informed decision to enhance your routine trading activities.

These leverage based derivate products support traders for speculating on the price of the security devoid of requirement to own the underlying instrument.

Though these two products share some characteristics, there are some key differences. For example, the way these products are treated for the tax-spread bets is the main difference.

These tax-spread bets are free from capital gain tax CFDs are not tax free in the United Kingdom.

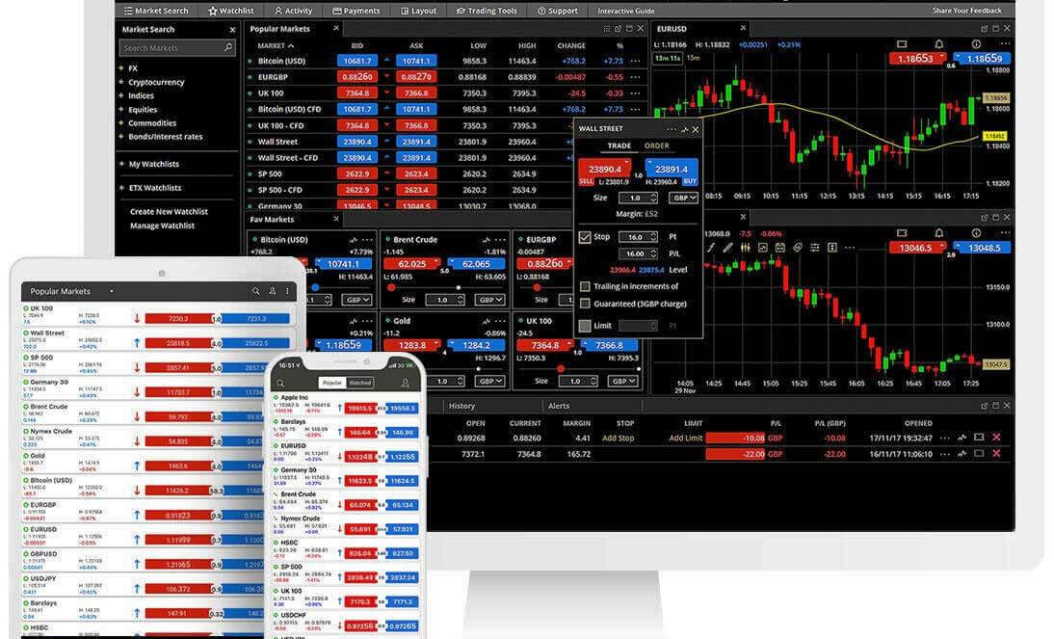

Compare the best trading options

CFD equity trades ask for a commission, but spread bets on shares do not. There is a fixed expiry date for the spread bets.

On the other hand, CFDs are excluding the futures and binaries and options. They do not have an expiry date.

There is no requirement for paying the stamp duty with the CFD. On the other hand, you must pay capital gains tax on the profits.

You have to keep in mind that losses can be used to offset the taxes elsewhere. Many platforms on online these days’ reveal spread betting vs CFD trading with an aim to guide people to make a well-informed decision and make money as maximum as possible.

ETX Capital is a one-stop-destination where you can make use of the best facilities for spread betting and trading on the CFDs across loads of markets.

Conclusion

Experts in the CFD vs spread betting in terms of the basics, benefits and drawbacks nowadays clarify their doubts and get enough guidance to be successful in their way to earn.

They mostly prefer the CFD due to its remarkable benefits.